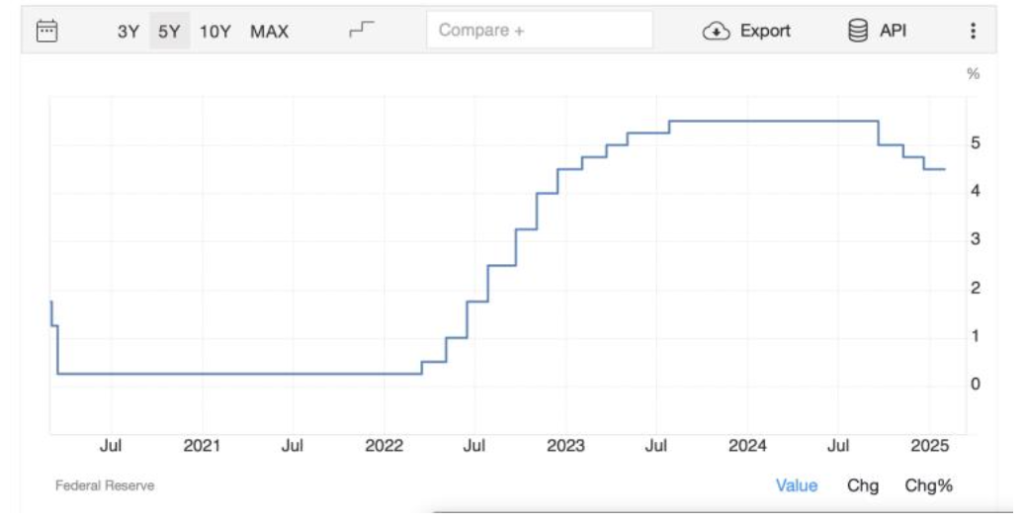

As President Donald Trump embarked on his second term, his approach to economic policy—particularly his focus on lowering interest rates through Treasury bonds rather than through the Federal Reserve—has raised questions about its effectiveness.

Trump: My Way or the Highway

President Trump’s leadership style, characterized by a direct and often confrontational approach, was evident from his early days in office. On his fourth day, he declared his intention to “demand that interest rates drop immediately,” signaling a strong desire to stimulate the U.S. economy through lower borrowing costs. This move aimed to boost economic activity by making lending more attractive, potentially increasing consumer spending and investment.

However, this approach brought him into conflict with the Federal Reserve and its chair, Jerome Powell. The Fed traditionally manages monetary policy, including setting interest rates, to balance economic growth with inflation control. Trump’s insistence on lower rates, despite the Fed’s independent mandate, highlighted his “my way or the highway” leadership style, raising questions about the balance of power in economic policymaking.

An Alternative from Treasury: I’ll do it myself

Rather than relying solely on the Federal Reserve, the Trump administration explored alternative avenues to influence interest rates. Treasury Secretary Scott Bessent outlined a plan to focus on the 10-year Treasury yield, a key benchmark for long-term interest rates, rather than the Fed’s short-term rates. This strategy aimed to lower long-term rates by influencing Treasury securities, thereby supporting economic growth without directly challenging the Fed’s independence.

The 10-year treasury bond yield is at 4.478%, while the Fed rate is at 4.5% as of 16 Feb 2025.

This approach is particularly intriguing given the historical collaboration between the Treasury and the Federal Reserve. Traditionally, the Treasury focuses on fiscal policy, while the Fed handles monetary policy. By targeting the 10-year yield, the administration sought to carve out its own path, potentially impacting the Phillips Curve by influencing inflation expectations and economic activity.

Philips Curve is a Trade-Off Between Interest Rate and Economic Growth (Unemployment)

On the other hand, Trump faces the challenge of prioritizing either high economic growth—which typically leads to low unemployment but can increase inflation—or maintaining low inflation, which might slow growth and raise unemployment.

For now, it looks like Trump wants both. Achieving a balance is essential for sustainable economic progress, requiring a strategic mix of fiscal policies alongside the Federal Reserve’s monetary policies.

Treasury Bond Pricing is Done Through Auction

Despite these efforts, the Treasury’s ability to influence the 10-year yield is limited. Treasury securities are issued through a highly regulated auction process, ensuring transparency and market-driven pricing.

If the yield is set too low, investor interest may be low, reducing liquidity and the effectiveness of this strategy. Furthermore, large institutional investors, such as banks and pension funds, typically require liquid markets to manage their portfolios effectively when the market is down. The treasury bond pricing is derived from market interest and liquidity preference post issuance.

Or (Maybe) Trump is Signaling a Low Interest Rate for the Future?

Alternatively, President Trump may be attempting to shape market expectations by creating the impression that interest rates will remain low in the future, creating an illusion that he is the “boss” in lowering interest rate. According to the Lucas critique, expectations about economic policy can become self-fulfilling prophecies. By focusing on setting the 10-year Treasury bond rate, Trump might be signaling to the market that lower rates are on the horizon, hoping that this perception will influence economic behavior.

If market participants believe in this narrative, it could lead to increased investment and spending, potentially pressuring the Federal Reserve to adjust its policies accordingly. This strategy hinges on the power of expectations to drive economic outcomes, illustrating the complex interplay between fiscal signaling and monetary policy. By leveraging this approach, Trump aims to steer the economy toward his desired outcomes, highlighting the intricate dance between perception and reality in economic policymaking.

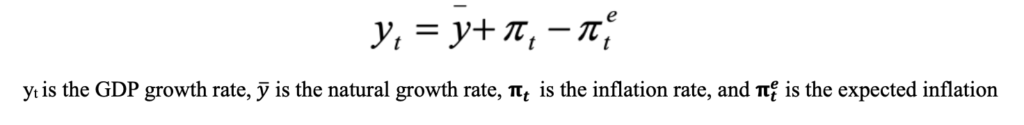

But Ultimately, It Is Expected Inflation That Drives Interest Rates

But ultimately, the rate on Treasury securities is determined by market expectations of inflation. No matter how much the government desires lower rates, inflation expectations play a crucial role in setting yields.

As shown in the formula above, the real interest rate can be influenced by the difference between actual and expected inflation.

When actual inflation () is higher than expected inflation (

), it can lead to a lower real interest rate, which can stimulate economic growth (yt). Conversely, if expected inflation is higher, it can lead to a higher real interest rate, potentially slowing down growth.

Investors are very risk-return oriented. If investors anticipate higher inflation, they will demand higher yields to compensate for the erosion of purchasing power, potentially counteracting the administration’s efforts.

The Federal Reserve Has Greater Influence Over Interest Rate Policy

In conclusion, the Federal Reserve wields greater influence over interest rate policy than the Treasury. Even if the Treasury were to successfully issue a 10-year bond with a yield lower than the prevailing interest rate, it would have minimal impact on the pricing of all marketable government securities. This is because such an issuance would represent only a small fraction of the overall market, which continues to look to the Fed’s rate as the primary benchmark.

Nevertheless, it will be interesting to observe how the market responds to President Trump’s maneuvers in the monetary arena.

References:

- Treasury Secretary Scott Bessent in an interview with Larry Kudlow at Fox Business Studios on February 5 in CNN Business, CNN

- https://treasurydirect.gov/auctions/announcements-data-results/announcement-results-press-releases/treasury-marketable/

- https://www.cnbc.com/quotes/US10Y

- https://tradingeconomics.com/united-states/interest-rate

Leave a Reply