Downstreaming is critical to boosting Indonesia’s economy past a 5% annual growth threshold. Danantara, the newly established sovereign wealth fund, plans to drive various downstreaming projects, spanning mining (nickel, bauxite, and copper), AI data centers, oil refineries, petrochemicals, and even food and aquaculture processing. Since many of these industries will be in their infancy, the government, through Danantara, will play a key role in supporting their development. However, it is important to acknowledge the inevitable trade-offs.

This essay will examine various analytical perspectives on the strategy, including: (I) a game theory perspective, which explores the necessity of private international investors and foreign direct investment (FDI) for Indonesia’s sustained long-term growth; (II) a step-by-step construction of a model that incorporates the benefits of downstreaming, highlighting the roles of research and development (R&D) and education/skill building; and (III) an analysis of rational expectations and market situation, focusing on the current dynamics of key markets and future projections.

- A Game Theory Perspective: Institutional Interactions between Government/Danantara and Private Investors

Game theory, the study of strategic interactions among rational decision-makers, provides a robust framework for analysing Indonesia’s proposed downstreaming initiatives. It explains the potential interactions between the government, acting through Danantara, and private investors.

| Private International InvestorsInvest | Private International Investors Do Not Invest | |

| Government Implements Supportive Policies | High Synergy: Both parties benefit from enhanced downstream development. Investors gain returns from a supportive environment while the government achieves its growth targets. | Partial Outcome: The government’s policies are in place, but without investor participation, the intended downstream benefits are under-realized. |

| Government Does Not Implement Supportive Policies | Risky Investment: Private investors face uncertainty and may invest cautiously, resulting in lower returns and slower growth. | Stagnation: With no supportive policies and lack of investor participation, downstream projects are stalled, leading to minimal economic impact. |

In this coordination game-like setting, the implementation of supportive government policies can incentivize firms to invest in downstream sectors, with each player’s decision significantly influencing the overall outcome. Historically, prior to the establishment of Danantara, the downstreaming industry was set in the stagnation scenario, characterized by the absence of supportive policies and a lack of private international investment due to perceived risks and low returns. This environment stifled the growth of downstream industries beyond their nascent stages.

With Danantara now operational, it is imperative to ensure that private international investors are actively engaged in the downstreaming industry. Danantara must not become a government monopoly within these sectors. Critical issues such as transparency, professionalism, and the avoidance of conflicts of interest must be prioritized to foster a conducive investment climate. Failure to address these concerns may result in a partial outcome, where government support is present but the anticipated downstream benefits remain unrealized.

- Evaluating Economic Growth Strategies through Downstreaming: Government Spending, Foreign Direct Investment, and Export Enhancement

The economic strategy utilizing the Danantara framework aims to stimulate economic growth (Y) by leveraging three key variables: government spending through Danantara (G), FDI – Foreign Direct Investment (I), and the export of downstream products (X). The fundamental equation representing this approach is:

Model 1

Y = C + I + G + (X – M)

where C denotes consumption and M represents imports

The successful implementation of downstreaming initiatives is anticipated to enhance Real GDP by positively influencing all three variables (G, I, & X). The immediate impact of this strategy is expected to be realized through the Danantara budget (G), which is allocated at IDR 327 trillion per annum. However, it is crucial to note that the funding source is derived from the pre-existing government budget within the APBN (State Budget). Consequently, the primary immediate effect is anticipated to arise from the multiplier effect associated with government spending.

The attraction of FDI is expected to bring not only financial resources but also technological advancements and managerial expertise, which are essential for sustainable economic development. Moreover, the focus on exporting downstream products is likely to improve the trade balance and stimulate domestic industries, thereby contributing to overall economic expansion.

While the initial reliance on government spending is significant, the long-term success of the Danantara strategy hinges on the effective mobilization of foreign direct investment and the strategic enhancement of export capabilities. These elements are critical for achieving sustained economic growth and improving the nation’s economic resilience.

Balancing Economic Growth: The Trade-Off between Overheating Inflation & Unemployment

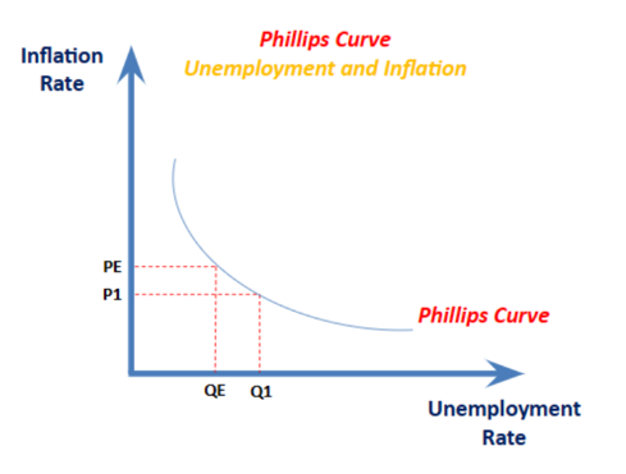

The traditional Phillips curve suggests an inverse relationship between inflation and unemployment in the short run. With the increase in output, especially beyond the economy’s potential, typically leads to higher inflation and lower unemployment in the short run.

Impact of downstreaming to the key variables in Phillips curve:

- Y (output) will increase due to increase in economic activity

- Unemployment typically will decrease as firms expand to meet international demand from export.

- Inflation: If export-led growth creates strong demand in the domestic economy, it may lead to higher wages and prices, moving the economy along the Phillips curve toward higher inflation.

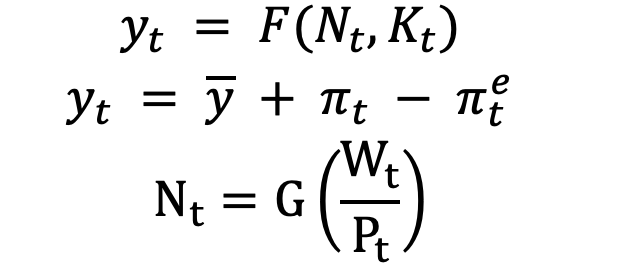

When unemployment is low, increased in economic activity tends to push wages and prices upward, resulting in higher inflation. In this model, the country’s production function is represented as:

Model 2

(all common assumptions applied e.g. the function F is assumed to have certain properties, such as being increasing and concave)

In this context, the production function includes both labor (N) and capital (K). Capital is a key variable, particularly as it increases due to foreign direct investment (I). As firms increase production, they will require more labor input, which may lead to higher wages and prices.

Short-Run Trade-Off

In the short term, the successful implementation of downstreaming and foreign direct investment (FDI) initiatives can lead to a reduction in unemployment. According to the Phillips curve framework, this reduction is likely to be accompanied by heightened inflationary pressures.

Foreign Direct Investment: Strategic Policy Frameworks for Advancing Indonesia’s R&D and Knowledge Accumulation

If strategically implemented, the downstreaming can elevate the country’s productivity, particularly through technology transfers inherent in FDI and the industrial. Consequently, the long-run Phillips curve may undergo a shift, characterized by an increase in potential output and a reduction in the natural rate of unemployment. This shift suggests that Indonesia could achieve lower inflation rates at any given level of unemployment.

The efficacy of knowledge and technology transfers is notably enhanced if Indonesia implements a foreign ownership limitations policy within the downstream industries. By mandating the formation of joint venture companies, foreign investors are compelled to collaborate with domestic entities, thereby boosting R&D and knowledge accumulation within the country. Another beneficial policy for the downstreaming strategy is to enforce close collaboration between downstream industries and higher education institutions. This approach ensures that accumulated knowledge enters the public domain, fostering broader dissemination and utilization.

The processes by which knowledge is generated and resources are allocated for its production represent a significant revision of the Solow growth model. This revision underscores the integration of knowledge and technology as endogenous factors in economic growth, highlighting their critical role in driving long-term economic expansion. The below is the revised model from model 2 above:

Model 3 – adding R&D

| Function | Remarks | |

| Output | Y = C + I + G + (X – M) | Same as Model 1. Downstreaming increases G, I, and X |

| Production function | Same as Model 2, K includes FDI investment. But, now include R&D and accumulated knowledge in the technology variable A | |

| Accumulated knowledge | ||

| Capital growth | Capital growth is driven by FDI | |

| Population growth | ||

| Expected inflation | Phillips curve | |

| Labor demand function | Here, Wt is the wage rate, Pt is the price level, and Nt is the quantity of labor demanded. The function G indicates that labor demand depends on the real wage |

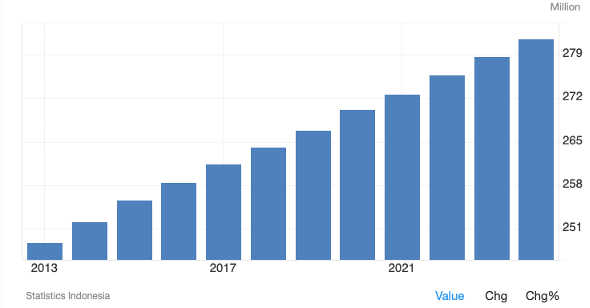

Indonesia Population Growth

The continuous increase in Indonesia’s population growth is evident. Consequently, in Model 3, we anticipate an expansion in the downstream industry. This expansion is expected to result in increases in investment (I) and capital (K), government expenditure (G), exports (X), accumulated knowledge (A), and the labor force (N).

The Solow model does not specifically account for rapid GDP growth over a short period; rather, it predicts stable, sustained growth. Within the Solow framework, GDP growth is driven by the adoption of technological advancements and the accumulation of knowledge, which collectively enhance the production function. Consequently, economic growth occurs gradually on an annual basis, rather than through significant leaps from year to year.

Advancing Human Capital and Knowledge Transfer: The Role of Managerial Regulation in Downstream Industry Joint Ventures

Drawing parallels to the historical regulation of Indonesia’s oil and gas sector, these joint ventures should ensure a balanced composition of managerial personnel, integrating both Indonesian and foreign expertise. This approach not only fosters a conducive environment for knowledge exchange but also strengthens the domestic workforce’s capacity to assimilate and leverage advanced technologies.

Solow Growth Model Enhanced with Human Capital: A Perspective by David Romer

To effectively capture the potential increase in productivity, we further adjust the Solow model, enhanced with considerations of human capital. In this updated model, human capital functions as a private good, while knowledge is regarded as a public good within a country. Knowledge is accessible to all firms and/or residents of the nation. Therefore, human capital, encompassing education and workforce skills, is deemed a critical factor in enhancing productivity and economic growth

Building from our previous model 3, the Solow model has been updated to include human capital variables within the function A , as follows:

Model 4 – adding Human Capital

| Function | Remarks | |

| Output | Y = C + I + G + (X – M) | Same |

| Production function | New variable added: Human Capital (H)Constant Return to Scale at K, H, & N | |

| Accumulated knowledge | Same | |

| Capital growth | Same | |

| Population growth | Same | |

| Expected inflation | ||

| Labor demand function | Same |

In this model, capital from FDI (K), human capital (H), and the labor force (N) are considered. Capital (K) and technology from foreign partnership (A) are treated as exogenous factors. Changes in physical capital and human capital in this model lead to significant variations in output (Y).

Capital (K) is subject to diminishing returns, necessitating continuous investment in new capital. In contrast, human capital (H) does not diminish, as knowledge continually accumulates. Specifically, knowledge aimed at enhancing production will consistently accumulate. However, physical capital must be balanced with human capital. For instance, if a country acquires drones, skilled pilots are still required to operate them. Similarly, there is always a “man behind the gun” in the development of AI technology.

The growth model, updated with human capital, demonstrates that improvements in human capital can shift the economic growth curve upward. In the context of Indonesia, enhancements in human capital through education and research will increase output per worker and drive faster economic growth in the future.

Physical capital, human capital, and output will each grow at a rate of n+g, while Y/L, K/L, and H/L will grow at a rate of g. The growth rate of output per worker is determined by the exogenous growth of technology.

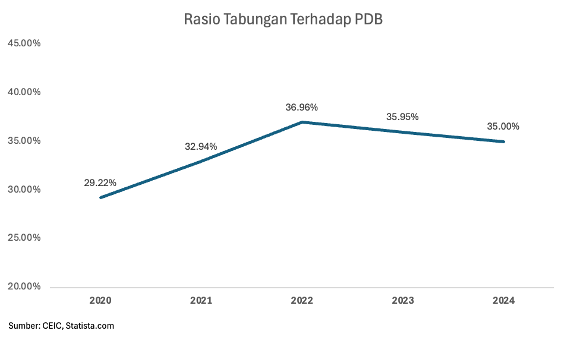

Indonesia Savings Needs to Improve – a Cornerstone in the Solow Growth Model

Even though Indonesia can potentially have a robust production function from downstreaming. The country’s overall saving is key in Solow growth model. This concern can also be seen in the declining middle class in Indonesia.

Over the past three years, Indonesia has experienced a notable decline in its savings-to-GDP ratio, decreasing from 36.96% in 2022 to 35.95% in 2023, and further to 35.0% in 2024. This downward trend in savings rates warrants careful consideration, particularly within the framework of the Solow Growth Model, which underscores the pivotal role of savings in influencing long-term economic outcomes.

The savings rate is a critical determinant of per capita income levels in the long run, although it does not directly affect the long-term growth rate. A decline in the savings rate can lead to slower capital accumulation, which in turn may impede future output growth and income levels. Should this trend persist, the rate of capital stock increase is likely to decelerate, potentially resulting in a lower steady-state level of output than what could be achieved with a higher savings rate.

By increasing savings, the nation can facilitate greater capital accumulation, thereby supporting higher levels of output and income in the long term. This strategic focus on increasing the savings rate is essential for sustaining robust economic growth and ensuring that the economy does not settle at a suboptimal steady-state output level.

- Market Situation

Rational Expectations of Danantara and Skepticism From the Stock Market

Danantara’s ambitious vision has encountered immediate market skepticism. In addition, to the current weak fiscal, low purchasing power, and depreciating currency, Danantara launch was a key story in the Indonesian market. In the days following its launch, the Indonesia Stock Exchange (IDX) experienced consistent declines, triggering several trading halts. The transfer of major state-owned enterprises (SOEs) such as Pertamina, PLN, BRI, Mandiri, and BNI from the Indonesia Investment Authority (INA) to Danantara appears to have unsettled investors, reflecting a lack of confidence in the new entity’s direction.

IDX’s reaction post-Danantara’s launch was notably weak, suggesting that investors do not view Danantara as a promising investment vehicle or a catalyst for immediate economic benefit. Unlike the optimistic receptions seen in other countries upon launching similar sovereign wealth funds, Indonesia’s market response indicates prevailing skepticism about Danantara’s future prospects.

Although the number of investors in Indonesia, approximately 15 million, in insignificant to its population. The market’s reaction signals a broader pessimism surrounding Danantara’s ambitious plans.

According to rational expectations theory, economic agents (public investors), are forward-looking and incorporate both historical data and anticipated policy changes into their decision-making processes. Therefore, the current market sentiment may reflect deeper concerns about Danantara’s potential impact on the economy.

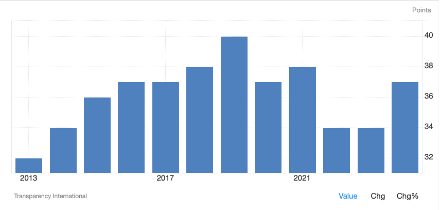

Such pessimism could become a self-fulfilling prophecy, as real-sector investors often consider public market performance when formulating long-term strategies. Critical issues such as transparency, professionalism, and the avoidance of conflicts of interest must be prioritized to foster a conducive investment climate. Indonesia’s score of 37 out of 100 on the 2024 Corruption Perceptions Index, as reported by Transparency International, highlights the urgent need for institutional and policy reforms. Without improvements in these areas, Indonesia may struggle to achieve the conditional convergence necessary for sustainable economic growth.

Corruption Perceptions Index reported by Transparency International

To ensure that downstreaming encourages economic growth, Indonesia must communicate clear signals and effectively manage investor expectations, ultimately cultivating a bullish stock market that eventually can attract private investments such as FDI.

Exchange Rate – How High Can it Go

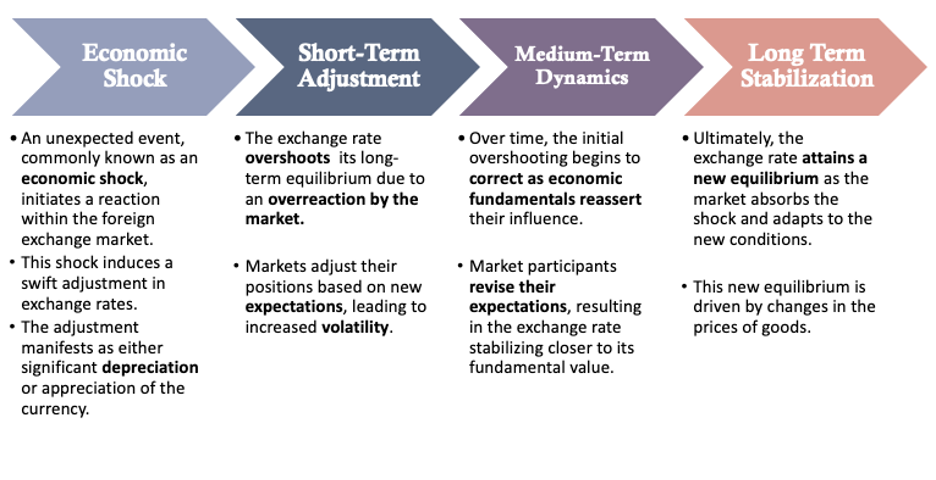

The current exchange rate situation in Indonesia, with the USD/IDR nearing historic highs at Rp16,569 (as of 24 March 2025), reflects a convergence of domestic and global pressures that can be analyzed through the lens of Dornbusch’s Overshooting Model.

This model posits that exchange rates may temporarily “overshoot” their long-term equilibrium in response to monetary policy shifts or external shocks, particularly when prices in the economy are slow to adjust (sticky prices).

In Indonesia’s case, skepticism in stock markets—driven by concerns over fiscal management, Danantara, and global uncertainty from Trump’s tariff war —has amplified capital outflows, worsening IDR depreciation. As investors flee emerging market assets for safer USD-denominated holdings, the sudden surge in USD demand pushes the exchange rate beyond levels justified by fundamentals, consistent with the overshooting phenomenon.

Dornbusch’s framework highlights the role of interest rate differentials and expectations. Indonesia’s central bank (Bank Indonesia) faces a dilemma: raising rates to defend the IDR could stifle economic growth, while holding rates risks further depreciation. As for 24 March 2025, Bank Indonesia has kept the rate stable at a 5.75%.

| Bank Indonesia Rate | The Fed Rate |

With the U.S. Federal Reserve maintaining a hawkish stance, the interest rate gap between the U.S. and Indonesia has widened, incentivizing capital flight. Market skepticism about Indonesia’s ability to manage inflation (which remains above target at ~5%) and its current account deficit adds momentum to the overshooting.

The IDR’s depreciation is further aggravated by sticky domestic prices, as businesses and wages adjust slowly, forcing the nominal exchange rate to absorb most of the shock from external imbalances.

So how high can the USD/IDR go? In the short term, the overshooting dynamic suggests the exchange rate could test new highs if stock market panic continues. However, the model also implies eventual correction once prices adjust and monetary policy transmission takes hold. Key factors limiting further depreciation include Bank Indonesia’s interventions (e.g., rate hikes, FX reserve deployment) and potential improvements in Indonesia’s terms of trade, particularly if commodity prices rebound.

Conclusion

Indonesia’s comprehensive downstreaming strategy—anchored by the launch of the Danantara sovereign wealth fund—marks a transformative shift in Indonesia’s economic trajectory. By leveraging aggressive export policies, strategic FDI attraction, and targeted government investments, the nation is positioned to stimulate significant GDP growth and reduce unemployment (Model 4). However, the policy framework also unveils inherent short-run trade-offs, as rapid economic expansion may induce overheating inflation and introduce transitional inefficiencies into the domestic market.

To achieve sustainable success, Indonesia must strategically balance its growth drivers with comprehensive structural reforms aimed at enhancing productivity, advancing technological and human capital development. It is imperative to establish transparent governance and implement robust professional oversight, alongside making targeted investments in research and skill-building initiatives. These measures are essential for fostering economic growth. Furthermore, the government must remain attuned to public perception and market expectations, including those related to the stock market and exchange rate fluctuations. By prioritizing clear communication and maintaining transparency, the government can gradually rebuild confidence among stakeholders, thereby reinforcing the nation’s economic stability and growth trajectory.

Ultimately, the nation’s ability to recalibrate its economic policies in light of these challenges will determine whether its ambitious downstreaming strategy can foster resilient long-term growth and secure a competitive edge in the global economy.

Leave a Reply